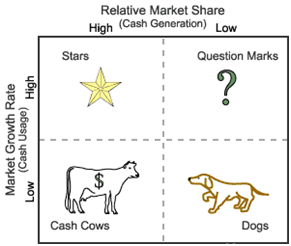

You may have noticed that the BCG matrix has a strong connection with a product life cycle: However, they do provide a certain balance and stability to your portfolio, so further investigation should be undertaken before prematurely killing off the unit. Therefore, businesses typically want to liquidate or divest money from dogs into more promising ventures – gradually phasing out the product. In other words, these are the products that break-even, neither creating nor consuming large amounts of cash. Investments in question marks are typically funded by cash flows from the cash cow quadrant.įinally, products within this quadrant hold a low market share in a slow-growth market. These products are typically the most challenging for businesses as initially, they’ll require a lot more cash investment than they can generate if you hope to increase their market share. Of course, the opposite is also true – when managed poorly they could drop down into the “dog” quadrant. However, if managed effectively, question marks have the potential to grow into future “stars” (literally 😅). Products in the “question mark” quadrant compete in a r apidly growing market with little to no market share. If a star continues its position as the market leader for an extended period of time, it will fall into the cash cow quadrant, as market growth begins to decline. Located in the upper-left quadrant, stars generate a lot of income, but in order to fight off competitors and perhaps even increase their market share, they’ll still require significant cash investment. Products with the lion’s share of a fast-growing market are known as “stars”. Companies should therefore milk their cash cows and divert funds to more experimental projects, i.e. Typically located in the lower-left quadrant, cash cows are a company’s flagship products in mature markets.Īs such, little investment is required to fight off competition making these some of the most profitable assets. Products with relatively low-growth rates but with large market shares are known as “cash cows”.

The Boston Consulting Group’s growth share matrix (commonly referred to as the BCG matrix) is a business tool that reviews a company’s product portfolio or SBUs (strategic business units) to help them decide in what to invest, what to discontinue, and which products to develop further.

0 kommentar(er)

0 kommentar(er)